Africa is a market of great opportunities and also of lost opportunities. The second largest continent in the world is slowly rising from his knees – at least in the area of payments. According to data from the African Development Bank, the Black Continent has the fastest growing middle class […]

fintech

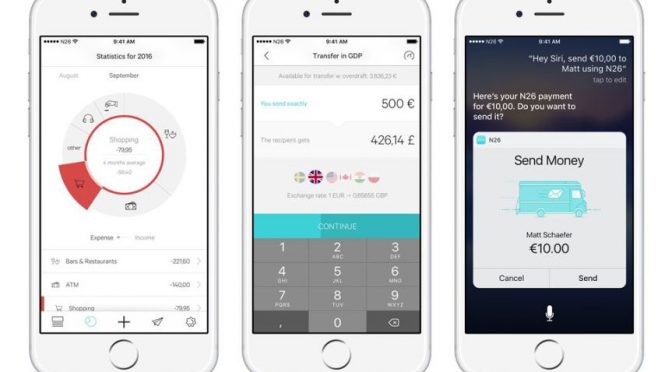

The company, formerly known as Number26, now offers accounts in 17 European countries. Bank-based mobile application extends its services to Belgium, Estonia, Finland, Latvia, Lithuania, Luxembourg, Netherlands, Portugal and Slovenia. Like the Atom Bank in the UK and GoBank in the United States, N26 is a fully mobile bank. Opening […]